Nightclub owners face specific risks due to the nature of the business. Find out what coverage you need to protect your business from loss.

Covering All Angles: How to Ensure Your Bounce House Insurance Is Comprehensive

We will explore the risks associated with operating an inflatable rental business and explain how to obtain bounce house liability insurance.

Bar Insurance Bargains: Effective Ways to Lower Your Premiums

Bars can reduce your insurance costs, liability, and risks by implementing effective strategies by Pro Insurance Group.

Insurance A Restaurant Needs To Have To Cover Their Restaurant Operations

Business owners can protect themselves and their restaurant assets and employees with the appropriate restaurant insurance policies.

Most Common Restaurant Equipment Breakdowns Covered By Insurance

See how equipment breakdown insurance differs from commercial property coverage and learn about the common restaurant equipment failures.

What Type of Restaurants Need Food Insurance?

Learn about the types of restaurants that need food insurance and the coverage options available for better financial security.

What Insurance Should Restaurants Have to Protect Their Employees?

Read about the policies that protect employees with restaurant insurance is one of the most effective methods and benefits the employer.

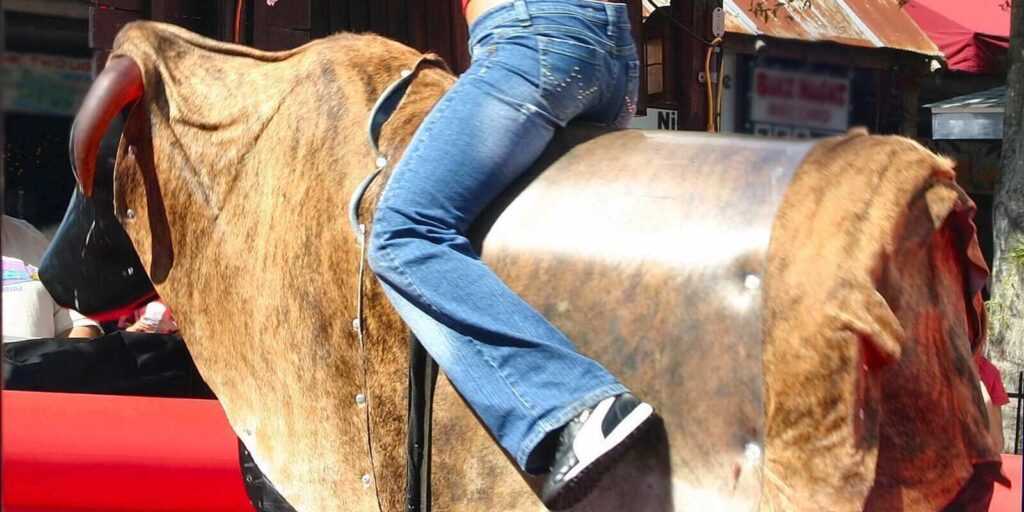

Insuring Against Accidents and Injuries in Your Mechanical Bull Business

With a comprehensive insurance policy, mechanical bull operators less likely to face significant losses from financial damages from injuries.

How Mechanical Bull Operators Can Minimize Risk Through Insurance

Learn more about the vital role each plays in protecting customers and reducing financial risk with Pro Insurance Group.